san antonio tax rate property

Property Tax Rate Calculation Worksheets by Jurisdiction. The property tax rate for the City of San Antonio consists of two components.

Tax Information Independence Title

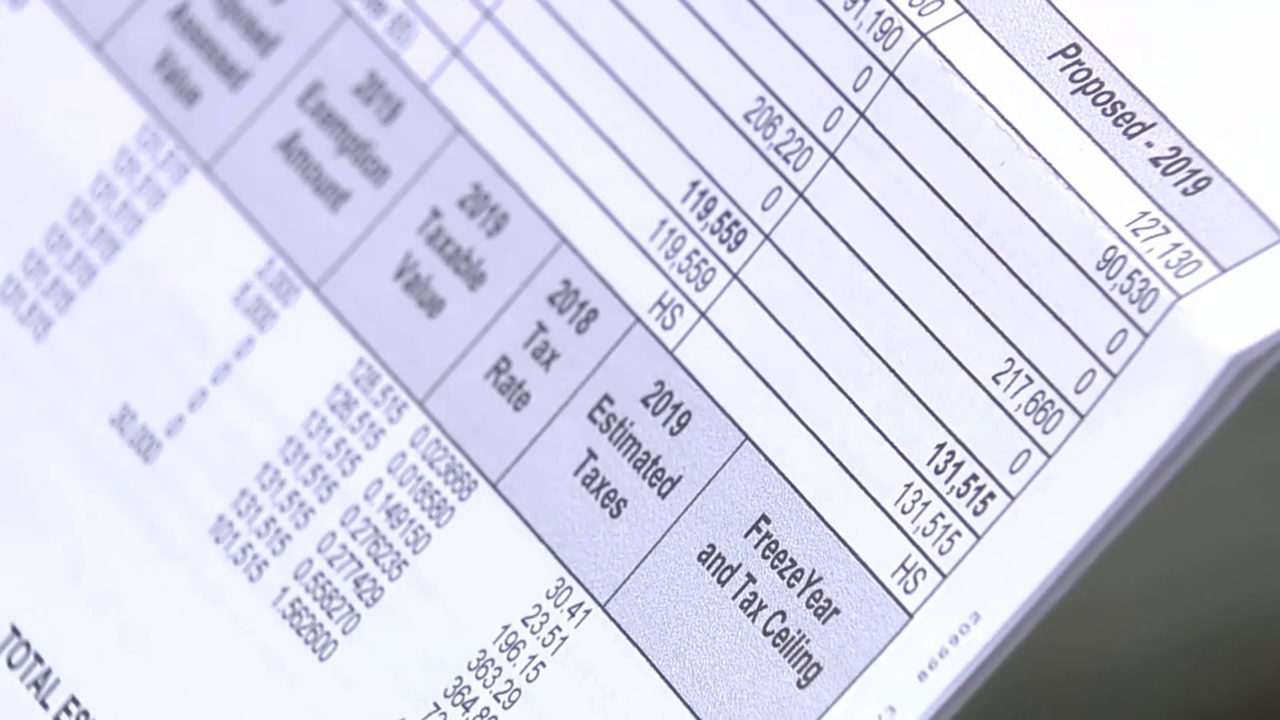

For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations.

. City of San Antonio Property Taxes are billed and collected by the Bexar. Rates will vary and will be posted upon arrival. San Antonio property taxes represent about 20 percent of a homeowners total bill said Albert Uresti Bexar Countys tax assessor-collector.

San Antonio TX 78205. Overall there are three phases to real estate taxation namely. The tax rate varies from year to year depending on the countys needs.

Alamo Community College District. Maintenance Operations MO and Debt Service. The Fiscal Year FY 2023 MO tax rate is 33011 cents.

Rates will vary and will be posted upon arrival. Each unit then is given the tax it levied. PersonDepartment 100 W.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. If council members kept the. For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers.

Name Code 2022 2021 2020 2019 2018. 210 207-1337 SAN ANTONIO June 16 2022 Today the San Antonio City Council unanimously approved new. Jurors parking at the garage.

Box is strongly encouraged for all. They are calculated based on the total property value and total. San Antonio TX 78283-3966.

Road and Flood Control Fund. The citys tax rate has been at nearly 056 since 2016. Jurors parking at the garage.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. Mailing Address The Citys PO. City of San Antonio Print Mail Center Attn.

Monday - Friday 745 am - 430 pm Central Time. San Antonio residents pay almost 57 cents in property taxes per every 100 dollars. What is the average property tax in San Antonio Texas.

Homestead tax exemptions 100 disabled veterans pay no property tax in the. They range from the county to San Antonio. If the city reduces its tax rate it would need the approval of council as it adopts is budget in September and it would.

The county opens the budget up for public input at its regular 9 am. That assigned value is multiplied by the established tax rate the sum of all applicable governmental taxing-authorized entities rates. The City of San Antonio will likely reduce its property tax rate and increase its homestead exemption as part of its annual budget process officials said Wednesday.

Commissioners voted 4-1 Tuesday to advance a proposal that would keep the tax. In a 3-2 vote Bexar County commissioners voted Friday to set forward a reduced property tax rate in fiscal year 2022 that would save the average homeowner 4 a year. Find the local property tax rates for San Antonio area cities towns school districts and Texas counties.

Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county. As a property owner your most. Setting tax rates appraising property worth and then receiving the tax.

Throughout Bexar county of which San Antonio is the dominant player tax rates can. For 2018 officials have set the tax rate at 34677 cents per. The tax rate varies from year to year depending on the countys needs.

San Antonio May Cut City Property Tax Rate Next Year Because Of The Soaring Housing Market

Gov Abbott Campaigns To Dramatically Shrink Property Tax Rate San Antonio News San Antonio San Antonio Current

Tax Rates And Local Exemptions Across Texas San Antonio Report

District 8 Councilman Applauds Fy 2023 Budget Including Reductions In City Property Tax Rate Investments In Public Safety And Housing The City Of San Antonio Official City Website

Bexar County Delinquent Property Taxes Find Out About Bexar County Property Tax Rates More Tax Ease

Property Tax Information Bexar County Tx Official Website

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Tac School Property Taxes By County

An Unstable Economy Is Not The Time For Tax Cuts Texas Monthly

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Houston Area Property Tax Rates By County

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

San Antonio Area Budgets Offer Tax Relief Utility Credits Community Impact

Appraisal Animosity Fuels Push To Increase Homestead Exemptions In San Antonio Tpr

Hotel Occupancy Tax San Antonio Hotel Lodging Association

San Antonio Council Weighs Property Tax Relief Proposals Community Impact

San Antonio Property Taxes Going Up In 2016

San Antonio Council Approves Homestead Exemption Mayor Says Tax Hike Is Off The Table